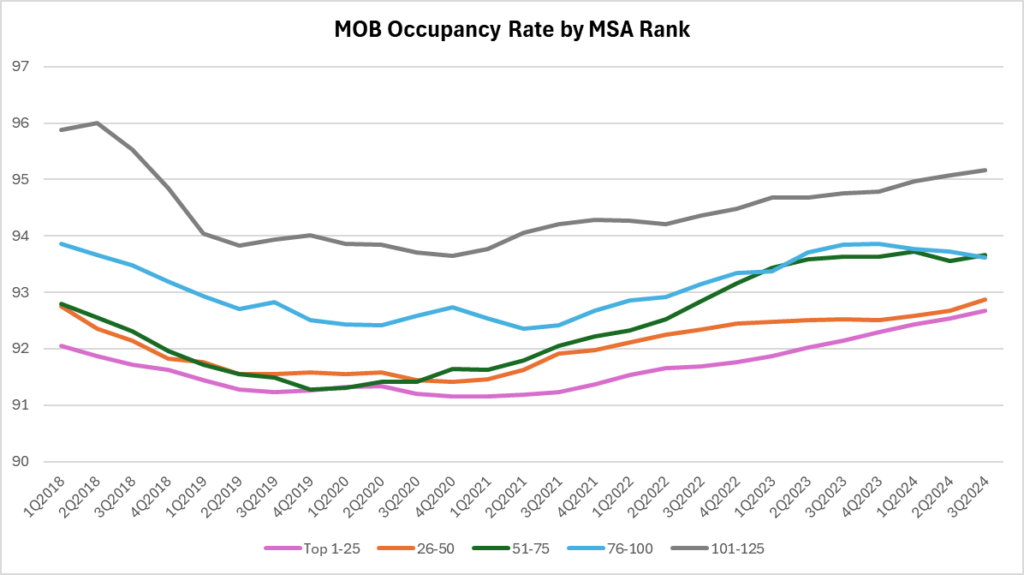

Long-time owners of healthcare properties have recognized this phenomenon for a while – tertiary markets offer high occupancy and high probability of renewal – contrary to conventional investment wisdom in other real property classes. The average occupancy rate in the Top 100 U.S. metros is at an all-time high of 92.9% in the third quarter of 2024. However, smaller metros (ranked #101-125) beat this record with occupancy at 95.2%. Think Fayetteville, Arkansas – #100 on the list – with nearly 600,000 people. And Salem, Oregon, coming in at #125, with a population of 436,000. Mighty New York with a metro population of 19.5 million and its Top 25 peers came in at the quintile low occupancy of 92.7%.

Why?

- Healthcare is everywhere! It’s one of the essential services needed by people wherever they live, along with necessities such as groceries, bank, drug store, mobile phone store, etc.

- Smaller communities are more likely to have purpose built medical, driven by demand from a specific provider. It is uncommon to have speculative development or overbuilding in small markets, making them more stable investment environments. From 2019 to today, the number of square feet of MOB completed in the Top 50 metros exceeded absorption by 4.3%. In the metros ranked 51-125, new supply exceeded absorption by only 1.8%.

- Medical practices are sticky tenants with high probability of renewal relative to other property classes. While the stick factor is common throughout the country, small markets have fewer suitable options for relocation. It is not unusual for a patient to go to the same medical building for care from cradle to grave in a small market.

- Investment grade health system tenants can be anywhere, and leading specialty or multi-specialty practice groups are as common in small markets as big markets. With continued consolidation and M&A activity, hospitals in small markets are being gobbled up by major regional players. Credit quality of the tenant goes up, more clinical support from the acquirer helps to improve access to care and quality for area patients. As these services grow, it is not uncommon to see development of larger purpose-built Class A MOBs to house an expansion of services.