- Medical office sales in 2018 remained vibrant as cyclical real estate investment trends drove investor interest to stable income-producing properties such as healthcare with strong and long-dated tenancy. 2018 activity reinforced the acceptance of medical office coming out of the shadows of alternative investments.

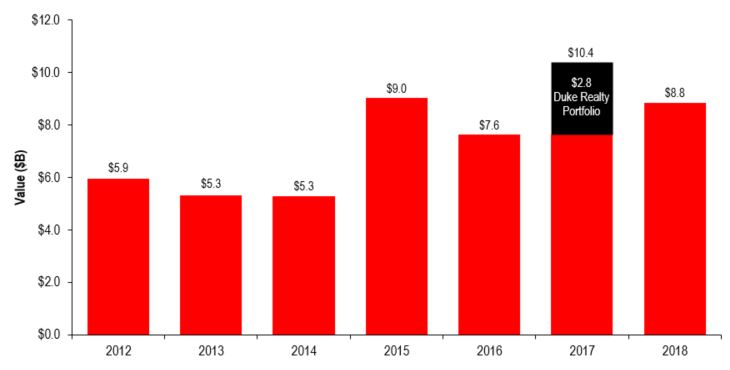

- While total volume in 2018 is off of the seeming peak in 2017 with $10.4 billion in reported sales, when adjusted for the $2.8 billion blockbuster Duke Realty healthcare division spinout, 2018 sales were remarkably robust. Five large portfolios in 2017 comprised nearly half the sales volume while all portfolios in 2018 comprised only 35% of volume. This means there were a solid number of one-off investment opportunities to sate the swelling amount of capital to be deployed in healthcare properties. The strong supply of individualassets on the market in 2018 was fueled, no doubt, by the improved value of medical properties as the asset class has gained institutional acceptance.

- The high level of new outpatient construction, reported by Revista at $9.8 billion of completions in 2018 – a peak level since 2007 – is an important investment vehicle for institutional investors in medical office.

- The financing environment for healthcare properties continued as a bright spot with lenders, especially with experienced specialists with strong underwriting acumen. Supportive financing terms for loan advance, amortization and interest rate reinforced strong property values and investor returns.

- Medical office remains one of the favored sectors for real estate investment at this point in the cycle as evidenced by new investors, including many mainstream institutions and managers, driven by the compelling investment thesis for medical office that is contributing to new investment supply. The demand-driven increase in healthcare services from a growing and aging population distinguishes medical office as healthcare providers increasingly establish new settings offering lower cost outpatient care.

Home / Policy/Legislation / 2018 Medical Office Sales Remain at High Level Total – Medical Office Investment Sales