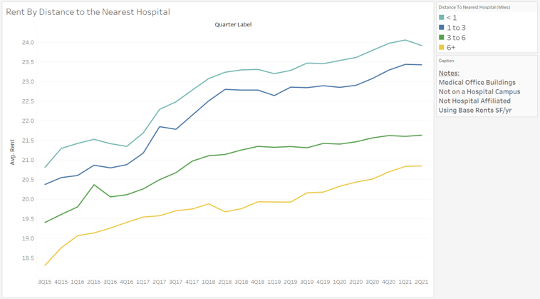

Are MOB rents significantly higher when in close proximity to a hospital? To isolate the effect a property’s distance from the nearest hospital has on rent, we looked at a dataset of MOB’s that are not affiliated with a hospital, nor directly on a hospital campus. It is plausible that on campus and hospital affiliated properties have a rent premium, which could inflate the average rents of MOB’s that are close by to hospitals.

Below is a graph that shows the rent trends for the last 6 years. The different lines are based on a property’s distance to the closest hospital in miles. Each line maintains a gap of around $0.5-$1.5 with their adjacent, and the lowest and highest lines maintain a gap of around $2-$4. The order of the lines follows the conventional idea that there is a correlation between being close to a hospital and higher rents.

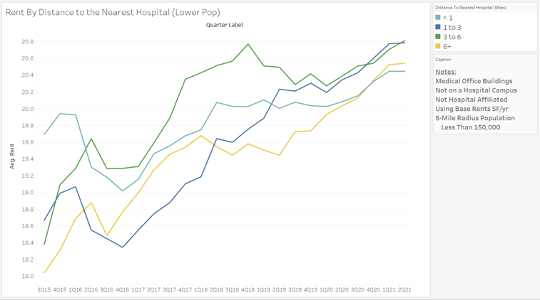

One possible contributor to the difference between the groups is population density. We know that rent is more expensive in urban areas and part of the variation in this graph could be reflecting the higher rents that are charged in cities. Due to the large quantity of buildings, cities are going to have a lot more MOB’s that happen to be close to a hospital. To take a deeper look at this, the following graph is the same as the previous, except it only includes properties that have a population of less than 150,000 within a five-mile radius. These properties make up roughly the bottom third of the previous dataset, in terms of population density.

The resulting graph is different in several ways. The first being that there are a lot of crossovers between the lines, indicating that the previous correlation is not present within these less dense areas. The second is that there is a convergence that has been happening in the last year and a half. The properties closest to hospitals saw the least overall growth across the six-year period ($0.75), and the properties farthest away saw the largest ($2.50). This could be due to random variation, but it could also be indicating the increased demand for outpatient facilities that reach closer to communities. Make sure to stay tuned as we continue to observe these trends.