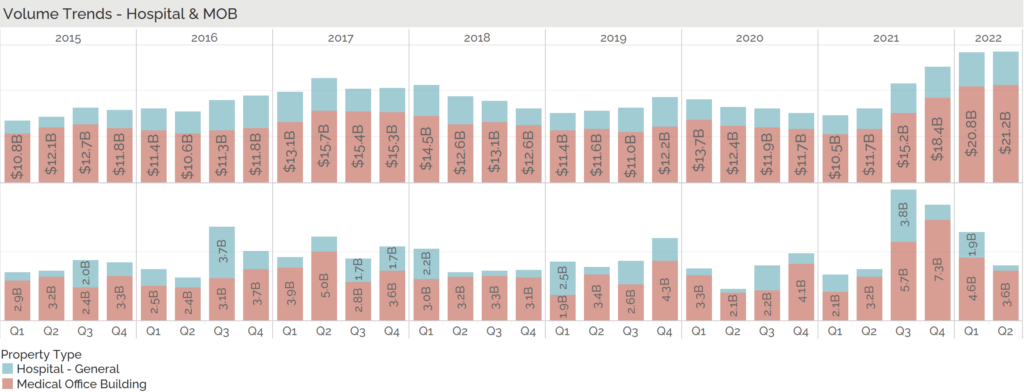

Preliminary numbers for sales transactions in the second quarter put total annual transaction volume at over $21 billion. This is a new high watermark for the sector since Revista has been tracking data. However, the second quarter itself is slightly off the recent quarterly highs we’ve been seeing with a preliminary total of $3.6 billion. In some part, this may be a natural cooling after an intense run of closings. It could also be investors responding to overall market volatility and choosing to sit out until there is more clarity. Eric Johnson, Executive Managing Director of the healthcare platform at Transwestern, was featured on our subscriber webcast last week and he agreed that there is new caution with some investors in light of rising interest rates and a potential recession. With near-term valuation shifts uncertain, some sellers are choosing to hold and some buyers are choosing to sit on the sidelines temporarily. Still, there is a lot of money waiting to invest in the sector and all the attributes that make medical office buildings an attractive investment will continue to draw interest. To hear more of Eric’s thoughts on the sector and see more of the latest Revista data, check out the 2Q22 Subscriber Webcast. Passcode: LP78U2f%