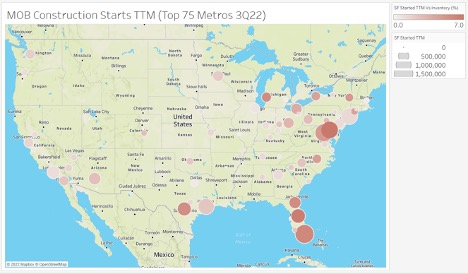

If we look at construction starts over the past year, we can see that a handful of markets have remained very strong despite increasing market headwinds. At a national level, annualized construction starts have been stable throughout 2022, hovering around 26 million square feet. Based on the map, we can see that certain clusters have substantial incoming growth, as long as the new projects go forward as expected. In particular, the CBSA’s in Florida and Maryland have had large amounts of square feet start construction, while being significant when compared to their existing inventory. The total square feet of the started projects are indicated by the size of the bubble and the comparison to the existing inventory is represented by the color. Baltimore, Washington D.C., Jacksonville, Orlando, and Miami, all had construction starts that were in the range of 4.9 – 7.0 percent of their inventory. For comparison, the average for the top 75 metros is 1.8 percent. Miami tops the charts with about 1.4 million sf of MOBs started in the past year, which is equal to 6% of its existing inventory. Make sure to stay tuned as Revista continues to keep a close eye on the construction trends.