The year of 2023 has brought significant drops in sales activity across the commercial real estate sector. The higher cost of capital is driving investors into cautiousness and the healthcare real estate market is not immune. While the underlying fundamentals of medical office buildings (MOBs) are currently quite strong, transaction volume has taken a hit.

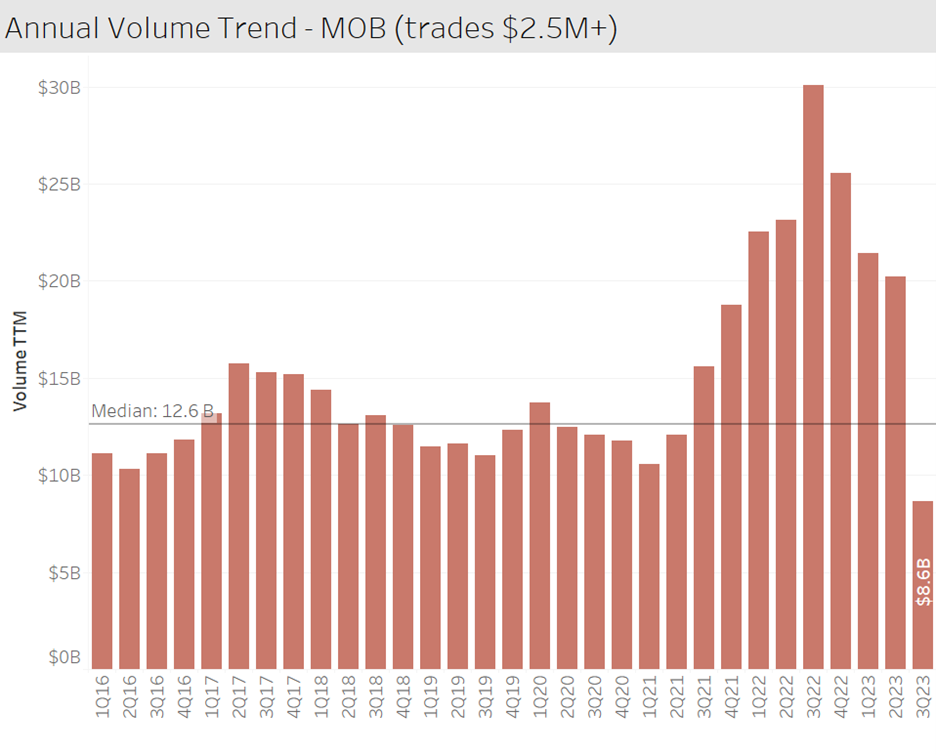

The graph below shows the volume trend on an annual basis. Looking at the number for 3Q23 we can see that there has been $8.6 billion of MOBs traded over the past twelve months. Keep in mind that this is a preliminary number, as over the next month Revista will continue to discover transactions that happened before the end of the quarter. If we compare this number from the peak in 2022, this looks like activity has fallen off a cliff, but it’s important to look at this number from a broader perspective. 2022 was an exceptionally high year for volume and this was exaggerated by the 11-billion-dollar HR-HTA acquisition. If we compare the current number to the median volume over the past 8 years, the drop looks much less drastic, about 32%. There is no doubt that sales are taking a hit, but a fair amount of deals are still going through. We will continue to monitor this statistic, so stay tuned for updates.