It is no secret that many healthcare services and procedures are increasingly moving towards an outpatient setting. Advances in technology, cost efficiencies and other factors have enabled this move which has led to consistent and steady growth of demand for outpatient space, and the underlying supply of such space. Revista normally tracks the supply/demand picture through its reporting of absorption, completions and occupancy rates.

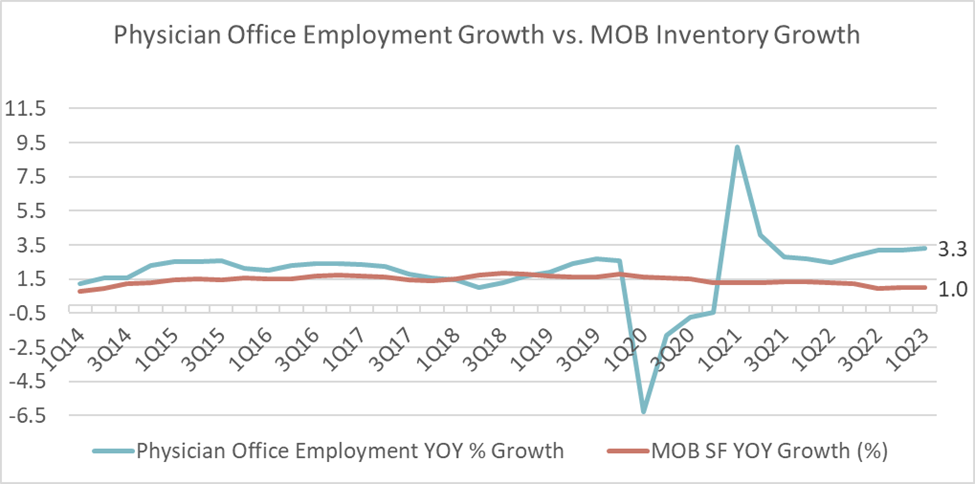

Another way to track the supply/demand picture of the outpatient sector is through growth in physician office employment compared to supply or inventory growth. The below graph displays physician office employment growth (data sourced from the U.S. Bureau of Labor Statistics) and compares it to outpatient or MOB inventory growth (data sourced from Revistamed.com).

Up until the Pandemic in 2020 physician office employment was growing at levels just above underlying inventory growth. Both measures grew under 3% annually during that time. The occupancy rates for the outpatient sector were fairly steady during this period of balanced supply and demand.

But a different picture has emerged since the pandemic. Namely, physician office employment is growing faster than underlying supply of space. As of the 3rd quarter of 2023, physician office employment grew 3.3% annually while the outpatient or MOB inventory grew by just 1%. Interestingly, during this period we have seen occupancy rates for the outpatient sector growing consistently as absorption of space has been outpacing completions.

Stay tuned to www.revistamed.com as we continue to track these trends.

Physician Office Employment Data Source; U.S. Bureau of Labor Statistics, All Employees, Offices of Physicians [CES6562110001], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CES6562110001, September 29, 2023.

Source and Copyright: Revista. Data believed to be accurate but not guaranteed and is subject to future revision. Use of this data is permitted subject to terms and conditions detailed on data.revistamed.com/terms-of-use and with proper credit to Revista or Revistamed.com.