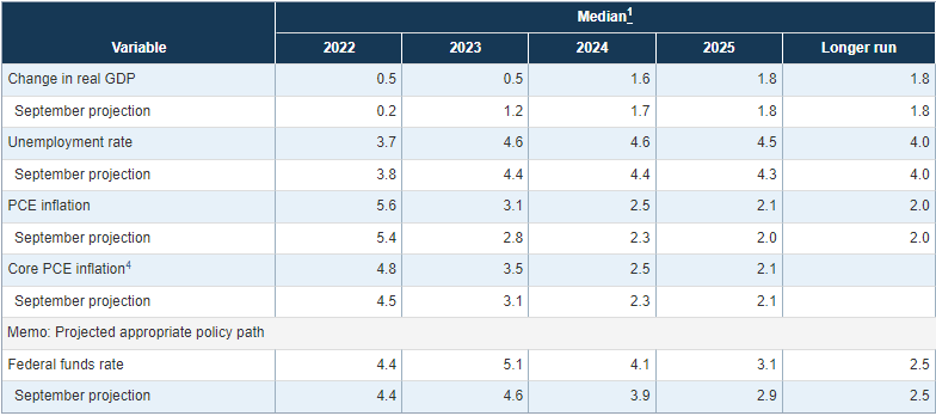

Last week the Federal Open Market Committee (FOMC) decided to raise the target range for the federal funds rate to 4.25% – 4.5%, which was a 50-bps increase. After several 75-bps bumps, the Fed has decided to slow the pace as the market begins to register the hefty changes received throughout the year. The chart below is from the Summary of Economic Projections, which is an aggregation of the projections provided by the participants in the FOMC meeting. The projection for each statistic is followed by the projections made in September of this year.

In 2023, the federal funds rate is expected to continue climbing alongside substantial decreases in inflation. If we compare the current projections to the ones made in September, we can see that the monetary policy changes have had a slower effect than previously thought. Inflation has been stickier, and as a result, the expected inflation rate and appropriate federal funds rate has been adjusted upwards for the coming years. Additionally, GDP growth has been adjusted downwards and the unemployment rate has been adjusted upwards. This reflects the more restrictive policy that will be necessary to bring down inflation. During the December meeting, Chairman Powell was clear that the Fed would not ease up until inflation is on a sustained downward trend and that they do not want to prematurely loosen policy.

It is evident that the cost of capital won’t be coming down in the next year, but the bulk of the rate hikes could be behind us. The estimate for the federal funds rate one year from now is only 70-bps higher than the current rate, indicating the Fed does not expect to need the large hikes they used this year. While no one expects 2023 to be painless, MOB fundamentals have not wavered, and Revista will continue to watch and see if the sector will prove itself yet again as one of the most stable and resilient asset classes.