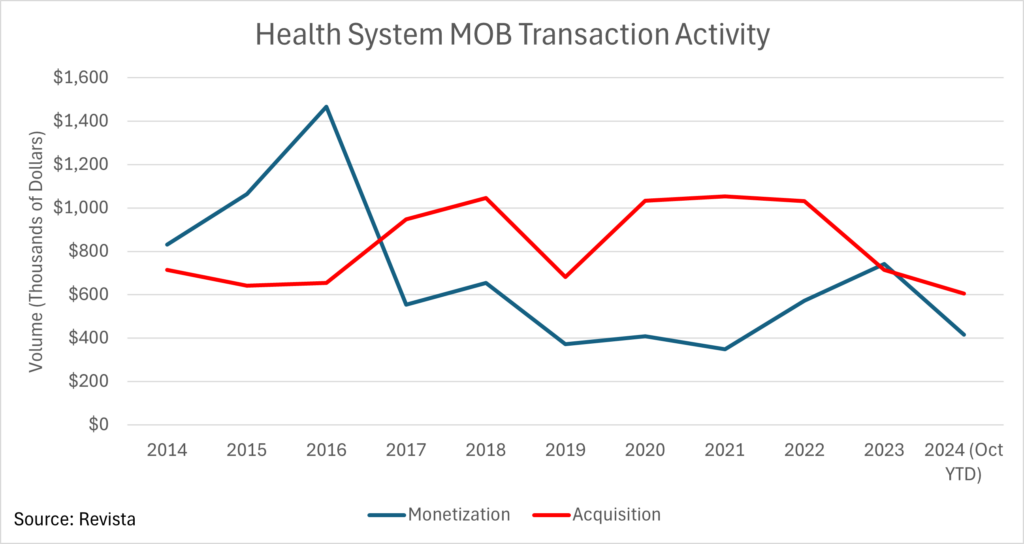

Health systems have been buying back outpatient medical buildings from third party investors at a faster clip in the last two years than in the past. This phenomenon is somewhat counterintuitive given the increase in interest rates since 2022 and lower operating margins in healthcare.

Health system activity from buybacks and dispositions of MOBs is a relatively small contributor to MOB transaction volume. Over the last 10 years, health systems have been involved in one side or the other of approximately 12% of sales. In the last two years, when transactions activity has been muted overall, health system activity made up 17-18% of market sales. Buybacks were greater than monetization on average – 7.4% compared to 6.0%.

At a time when interest rates have risen dramatically and hospitals are under continued margin pressure, why is this phenomenon occurring? With outpatient medical services generating more than 50% of net patient revenue at health systems, strategic ownership of facilities by the providers is a natural extension.

- The natural and historical proclivity by health systems to own real estate, dating back to the time when outpatient medical was centered at hospital campuses.

- Cash and investments levels have bounced back at health systems, with improving operating margins from the depths of the pandemic and the stock market rally which have fortified many health system balance sheets.

- Cap rates for MOBs have gone up to 10-year highs given the rise in general interest rates, allowing buybacks by health systems in the 6% range versus 5% at peak market, offering a discount of roughly 15-20% on the purchase price today.

- The historical relationship between tax-exempt and taxable bond rates has returned, offering the hospital borrowers the advantage of lower tax-exempt rates, if applicable for the first time since the Great Financial Crisis. Tax-exempt bonds in the 4% range offer a compelling benefit over taxable bonds at 6% or the higher cost of third party capital. Bond issuance has accelerated as improving health system fortunes and muni investor appetite has grown.

- Property tax savings from ownership are real and compelling, especially in high tax locations. It is not unusual for a third party MOB landlord to pass through property tax expense under triple net leases equal to $1 or $3 million. Eliminating rent escalations and upward market rent resets are another benefit for occupancy cost.

Buybacks may be prompted by a right of first refusal (ROFR) on a property sale. But they are just as likely to occur on a non-contractual basis. Owners seeking liquidity and/or faced with a refinancing event, especially with a short WALT property, have allowed health systems to negotiate favorable arrangements for themselves. A health system buyer is considered a motivated and reliable buyer, especially in a liquidity-limited lending environment. Health systems paying all cash offer certainty of execution given their deep balance sheet and nexus to the properties. Alternative financing structures such as credit tenant leases (CTL), synthetic leases, and not-for-profit lessors exist, making it possible to achieve other balance sheet, financial metric and P&L goals of a health system.

For additional information, contact Mindy Berman at mindy.berman66@icloud.com