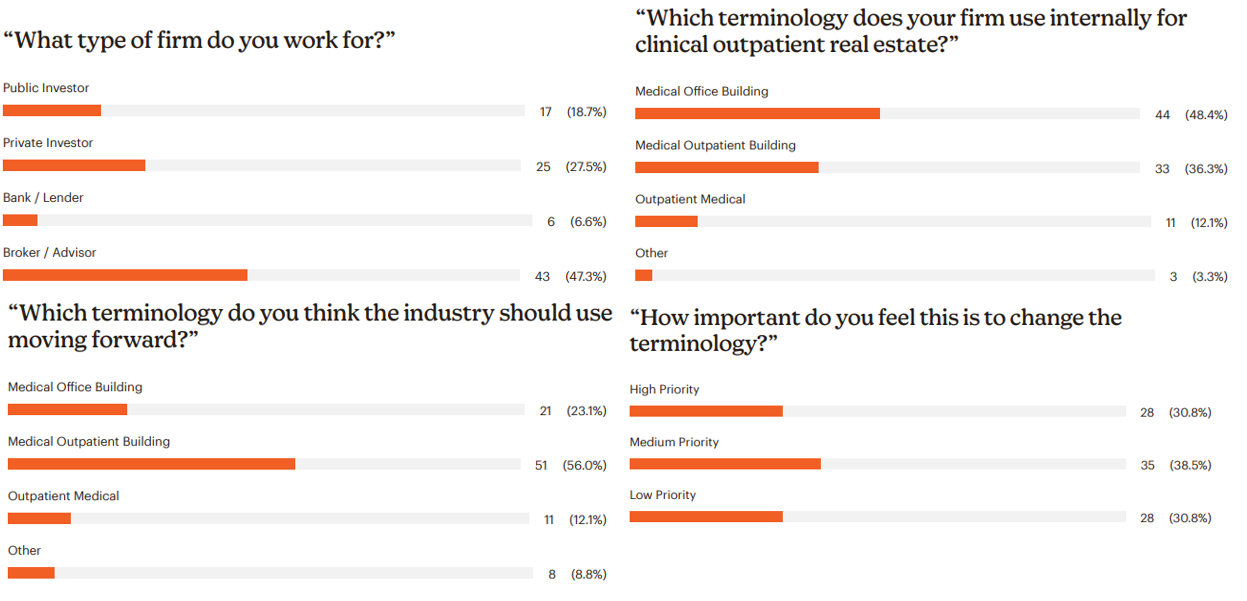

Recently there has been discussion about moving away from the term “Medical Office Building” (MOB) to an alternative that does not include the word office. MOBs are a distinctly different asset from standard office properties. Because of the consistent nature of healthcare demand, medical properties are more stable and do not get dragged down as much during the troughs of economic cycles. We can see evidence of this in recent years by comparing the strong occupancies maintained by MOBs compared to the occupancy decline seen in office. Many players in the healthcare real estate sector would like medical properties to be viewed as their own separate asset class, as opposed to how the general real estate industry perceives it, which is a subset of office. In order to gauge our industry’s thoughts on changing the term Medical Office Building, Revista’s Rising Leaders Council (RLC) worked on a survey that went out last month, which had the following results:

The survey indicated that the majority (56%) of respondents believe “Medical Outpatient Building” was the best option moving forward, and 36% were already working in a firm that used that term. The benefits of using “Medical Outpatient Building” are the removal of the word office, the emphasis on clinical operations, and the fact that the acronym MOB can still be used. However, 23% still preferred “Medical Office Building”, and there was a variety of opinions on whether a name change should be a priority and if it would provide any real value. A point put forward by many survey responders is how the association with office negatively effects lending. In times where the office sector is struggling, banks will limit lending towards medical office, due to them being considered the same category. On the other hand, many responders did not see any value in the name change, especially if commercial real estate institutions outside of our sector do not alter their perception. What do you think? Would a change in terms be a step in the right direction, or just a surface level adjustment that won’t have a real impact?

Revista Partners with Pivotal Analytics to Provide All-Payer Data Reports

Revista Partners with Pivotal Analytics to Provide All-Payer Data Reports