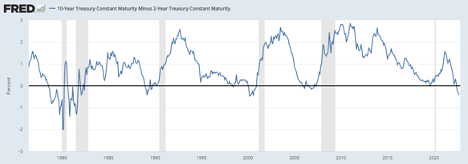

An inversion of the yield curve is a well-known indicator of a coming economic downturn. Using the difference between the 10-year and 2-year treasury spread, we can see that the difference became negative this July and has remained negative so far. Recessions, which are represented by the gray bars, are often preceded by a period with a negative spread. A negative spread means that the 10-year interest rate is lower than the 2-year. Most of the time, long term interest rates are above their short-term counterparts. This is due to the higher uncertainty that is faced the farther you go into the future. However, when the short-term rates are higher, it is indicating that market participants are pessimistic about how the economy will perform in the near future.

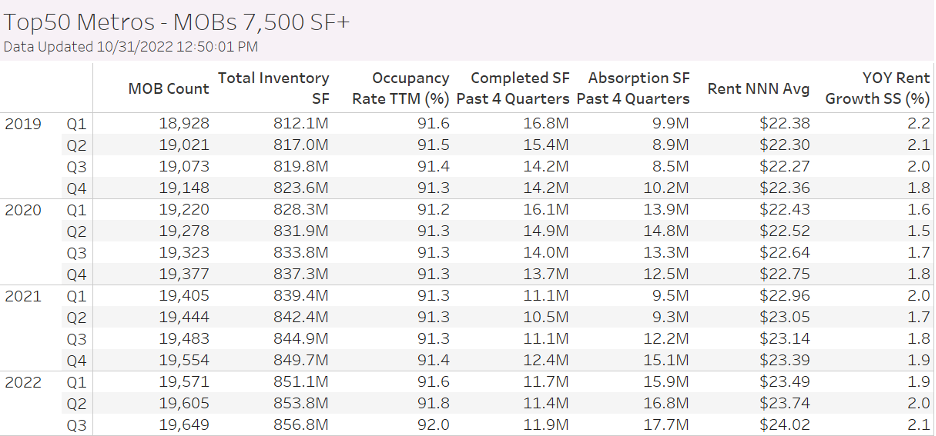

A negative 10-2 spread is a leading indicator of economic downturn, so a recession often takes some time to form. With all the gloom in the market, how is the MOB sector doing? At the close of 3Q22, we are still seeing strong overall fundamentals. Looking at the top 50 metros, our data is showing increased occupancy and rents. While construction completions are not what they were pre-pandemic, demand for space has continued to be strong with absorption of 17.7 million square feet in the past year.

For a more in depth look at the market, make sure to check out the recording of our 3Q22 webcast from last week.