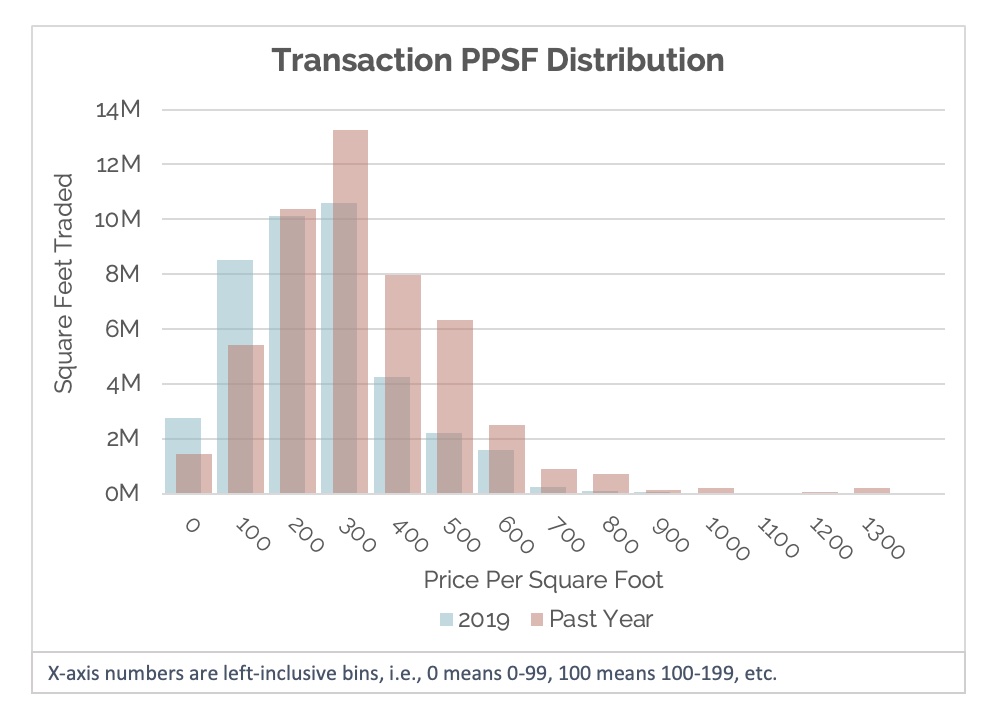

If you have been following our MOB transaction trends lately, you know that volume has been very high over the past year. In the second quarter of this year, Revista recorded new highs in annual transaction volume. To take a deeper dive into the transaction activity, we looked at the pricing distributions for this past year and compared it to 2019.

We can see that the recent increase in volume has come from properties trading at mid to high prices. During this past year, transactions in the range of $300-599 ppsf have around 10 million more square feet. On the contrary, transactions in the range of $0-199 ppsf have around 4 million less.

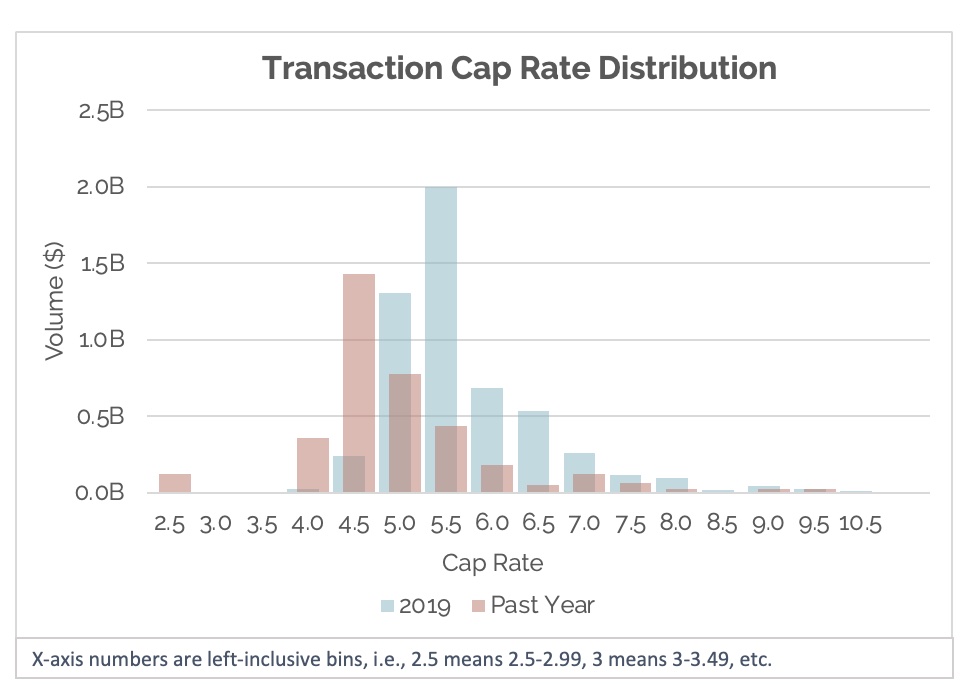

We can see similar patterns when looking at cap rates. The shapes of the distributions are alike, but this past year is shifted to the left, indicating a premium on recent transactions. There are a few possible contributors to the higher pricing we have been seeing. One is the influx of capital into the sector. More capital increases investor competition and therefore the prices of assets being sold. Another is the possibility that owners have been more willing to sell off some of their premium assets. The exact cause of this trend and whether it will continue as the FED continues to hike interest rates is unclear. Make sure to stay tuned, as we will keep you up to date on how things play out.