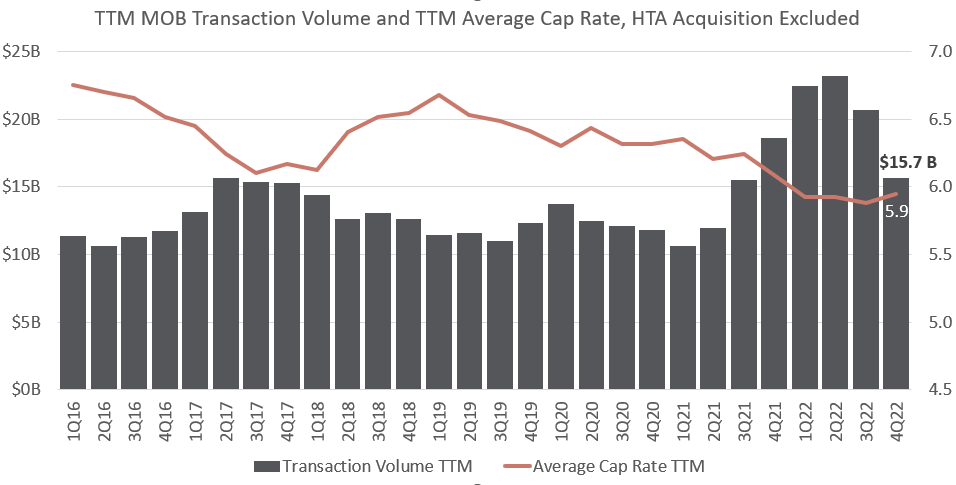

Data from the end of 2022 is beginning to reflect what many are feeling on the ground with a noticeable dip in MOB transaction volume and an upward creep in cap rates. Not including the HTA acquisition, 2022 ended with $15.7B in transaction volume and an average cap rate of 5.9%. (This data is preliminary.) Although down from the highs of late 2021 and early 2022, $15.7B to close out the year is still higher than what we had been seeing in the years leading up to the pandemic. The annual average cap rate is up slightly but still at a cyclical low point as it includes many deals that continued to close at old pricing, in addition to deals that closed earlier in the year before significant interest rate increases and lender tightening.

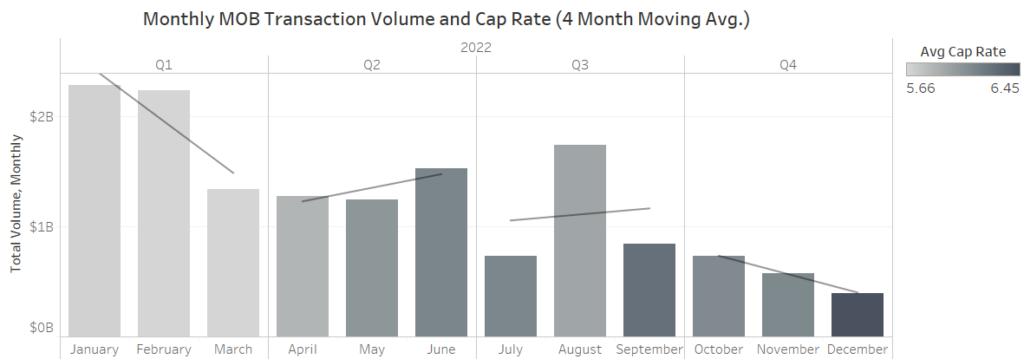

However, if we shorten from annual to a 4-month moving average, the change is more apparent. The 4-month moving average cap rate in the beginning of 2022 was 5.66% and ended up at 6.45% by December, in conjunction with a significant drop in volume. This reflects an 80-bps increase, a meaningful movement toward what the public markets have been reflecting. (According to Nareit, the implied cap rate of listed REITs was up 145 bps in 3Q22 from 2021.)

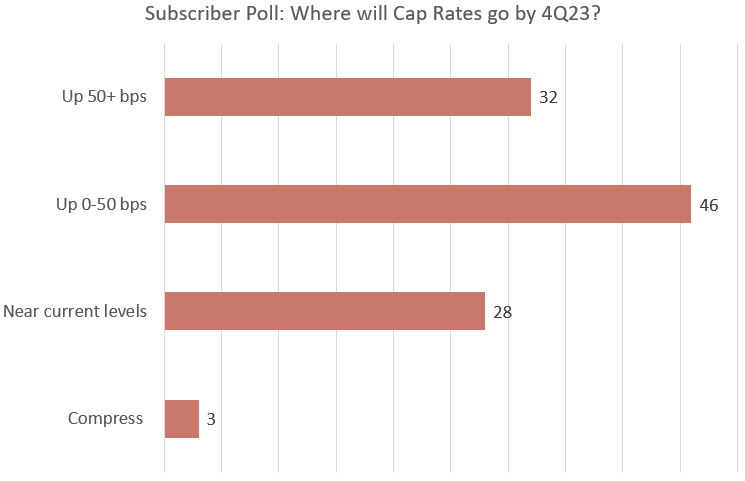

Where will cap rates go from here? On the 4Q22 Revista Subscriber Webcast we asked the question and 72% of the 109 subscribers who voted in the poll said we will continue to see an increase through the end of the year; 29% voted that increase would be more than 50 bps. Stay tuned to follow this trend and more into 2023!