The Covid-19 pandemic has had far reaching effects on many sectors of the US economy. While faring better than most sectors, the physician office sector has not been immune to the pandemic’s effects.

One way we can measure effects on physician offices is the look at monthly employment trends within the sector. The Bureau of Labor Statistics publishes monthly employment figures for employees within physician offices (Series CES6562110001).

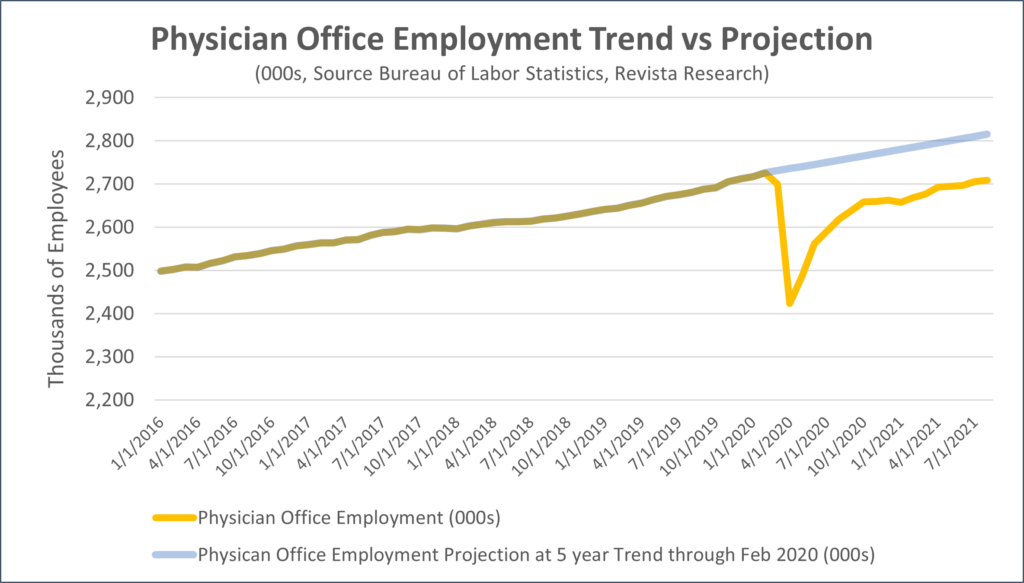

Generally, the number of employees had perpetually growth on an annual basis back into history including during the great recession. But the pandemic changed that. You can see the trend established a high in February of 2020. For the 5 years prior to Feb 2020 the number of employees was growing at a 1.9% annual rate. But by April of 2020 the sector had lost some 300,000 employees (decline of 11% from the February 2020 high).

As 2020 unfolded the sector was one of the first to return to work and the number of employees rose sharply and has continued to rise. In fact as of August, 2021 we are virtually near the February 2020 peak in terms of the number of employees in physician offices.

But if we look at the trend compared to where physician office employment should be we still have a ways to go to full employment. If the number of employees had continued to grow at that 1.9% rate we would be at ~2.8 million employees as of August 2021. But instead we are at ~2.7 million. This also compares to MOB inventory growth which has been growing during the pandemic.

According to the Revista 2Q Construction Report, Its annual growth rate (TTM completions) has ranged from 1.6% to 1.1% from 2Q20 to 3Q20. So this shows some of the gap in employment we are feeling within the sector. It is recovering well especially compared to other sectors but still has a ways to go to catch up to previous trends.