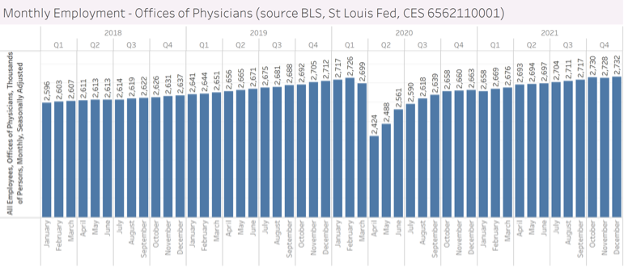

In what is a remarkable recovery compared to other sectors, physician office employment is now fully recovered from its losses experienced during the Covid-19 Pandemic. We are showing a graph below that displays monthly employment within offices of physicians in the US. The Bureau of Labor Statistics (BLS) collects and maintains this data and we are grabbing it from the St Louis Federal Reserve.

If the graph were stretched back in time you would see that physician office employment grows 2-3 percent annually even during economic downturns like the great recession. But that changed during the Covid-19 Pandemic. The graph below shows that employment peaked in February 2020 with 2.726 million employees (according to their survey). This figure fell to 2.424 million employees in April 2020. This was a drop of 11%.

But physician offices were some of the first businesses to open back up after the nationwide lockdowns experienced in 2020. By December of 2020 the number of employed in the sector was within 97% of the April highs. Its been a slow but consistent recovery since the end of 2020 and we finally climbed ahead of the February 2020 highs in November 2021.

Even though the recovery looks smooth at the national level, it is uneven across states. States like Maryland, Florida and New Jersey are all 5%+ ahead of February 2020 highs while states like New York, Massachusetts and Colorado are still 2%+ below the February 2020 peak.