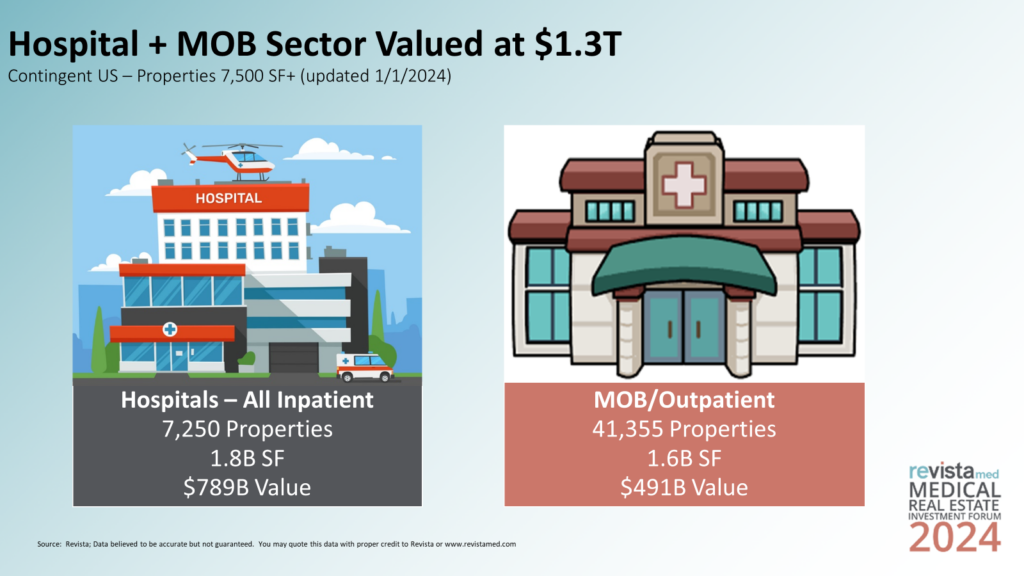

Revista has updated its annual look at the size and scope of the health care real estate sector. This update measures the real estate size and value of general acute care hospitals and outpatient buildings across the contingent United States.

Overall, the sector is valued at $1.3 Trillion as of 1/1/2024. The outpatient/MOB sector fell in value compared to the last update we completed in 2022. In 2022 the outpatient/MOB sector was valued at $509B or $327 per square foot. In 2024 the outpatient/MOB sector is valued at $491B or $315 per square foot.

The inpatient/hospital sector grew in value from $739B or $422 per square foot in 2022 to $789B or $428 per square foot in 2024.

Revista calculates the value of the outpatient/MOB sector based on actual counts of properties and square feet as well as current rents, net operating incomes, occupancies and capitalization rates. For the inpatient/hospital real estate sector we use transaction and construction comparisons as well as some estimated measures. For more information or questions on methodologies please contract Mike Hargrave at mike@revistamed.com.