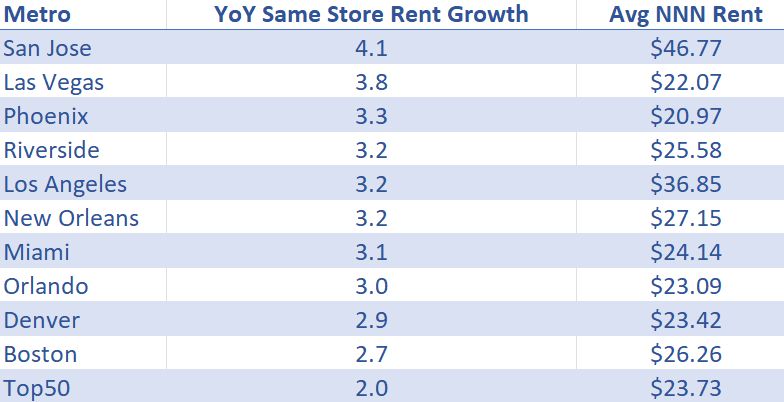

With continuing record inflation, the ability to raise rents is top of mind for many commercial real estate investors. One might be tempted to think that areas where overall inflation is the highest, rent growth would also be highest. For medical office buildings it’s not quite that simple. In many cases, demand for space is the bigger driver of rent growth. The areas where absorption of space is outpacing new supply are the areas where landlords and leasing agents are better able to raise rents. These dynamics can vary significantly from market to market. Out of the largest 50 metro areas, San Jose tops the list in terms of annual rent growth coming in at 4.1% year over year on a same store basis. This is more than two times the top 50 national average of 2%. San Jose has been seeing strong absorption and increasing occupancy since the second half of 2021. For reference, the Bay Area has been below the national average for overall inflation. Las Vegas, not far behind at 3.8% annual rent growth, has seen a significant increase in occupancy since it’s low point in 2020, climbing to 90% in the most recent quarter after a continuing spree of high absorption and relatively few deliveries. Going down the list, almost every metro in the top ten has seen this same dynamic of absorption outpacing new supply. In areas where this dynamic is reversed, whether related to softer demand or an influx of new supply, rent growth will be more limited and investors will feel the pressure – especially in those markets with higher inflation. Want to know where your market ranks? Subscribe to Revista!

Source and Copyright: Revista. Data believed to be accurate but not guaranteed and is subject to future revision. Use of this data is permitted subject to terms and conditions detailed on data.revistamed.com/terms-of-use and with proper credit to Revista or Revistamed.com.