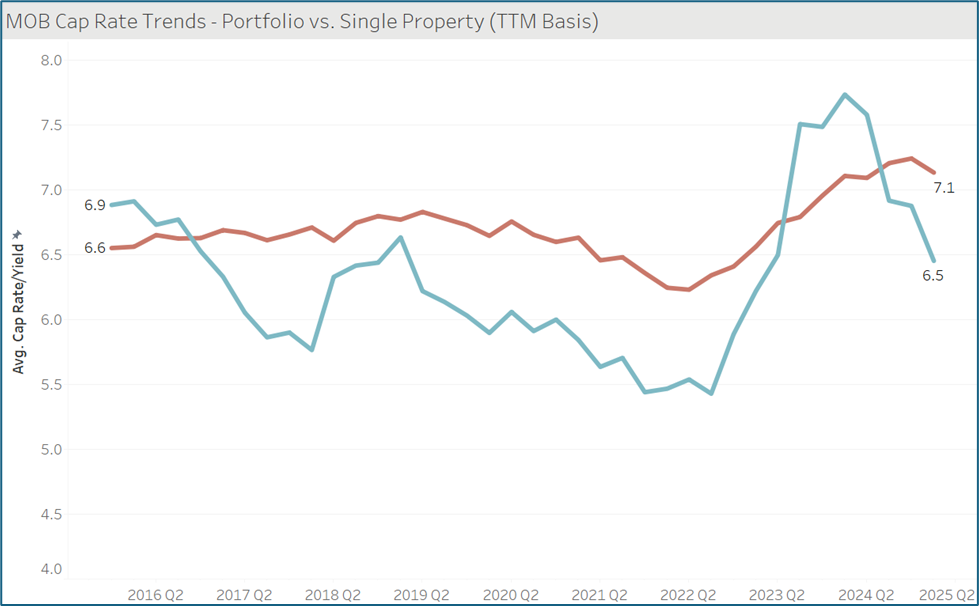

For many investors in Medical Office Buildings (MOBs), the concept of a portfolio premium has helped to drive an aggregation strategy. The idea is that, in addition to synergies developed from operations of portfolios vs. single properties, that portfolios also carry higher valuations compared to single MOBs. The data generally supports this thesis over time. The graph below displays Average MOB cap rate trends for Portfolios vs. Single Properties. From 2017 through 2022, the Average Cap Rate for MOB Portfolios was 63 basis points lower than single MOB properties that traded. This was generally considered the portfolio premium that developed during that period. This premium essentially disappeared in late 2023 when interest rates began to spike. Transaction activity slowed measurably and during the following year+ portfolios were trading at a discount relative to single properties. But in the second half of 2024 the portfolio premium began to emerge again. We have seen several portfolios trade since then and it is clear the portfolio premium is returning to the MOB investment landscape. As of 1Q25, MOB portfolios garnered an average TTM cap rate of 6.5% while single properties were at 7.1%.

Will this continue? Tune in to RevistaMed.com as we will monitor this emerging trend.

Interested in a subscription to RevistaMed.com? Schedule a demo today!

Or contact Mike Hargrave at mike@revistacompanies.com