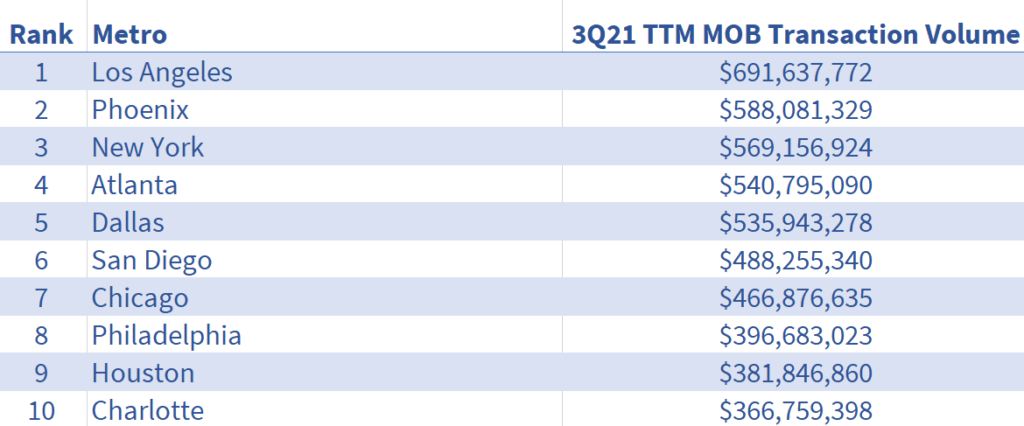

Last quarter was a record for medical office transaction volume since Revista has been tracking data, coming in at a total of $5.2B in sales. On an annual basis, that created a run rate of $14.3B. Ten markets make up 35% of the total annual volume with Los Angeles once again coming out on top with $692M trading hands. Most of the top ten most active markets also happen to be the largest markets, save for Phoenix, San Diego and Charlotte, which by total inventory rank 12, 18 & 29th respectively. Phoenix and Charlotte, despite being smaller than the others, tend to be favored by investors and that is reflected in their ownership makeup and continued high levels of activity.

San Diego is of particular interest with just under $500M in annual activity. This is the highest annual run rate this market has seen in the last few years and is largely made up of single property sales rather than portfolio trades. In fact, the largest single property sale for the time period is found in this market – the Pomerado Outpatient Pavilion, a 160K+ square foot MOB on the campus of Palomar Medical Center which was acquired by Healthcare Realty for $102M+ in late May. Want to see where your market ranks? Subscribe to Revista!