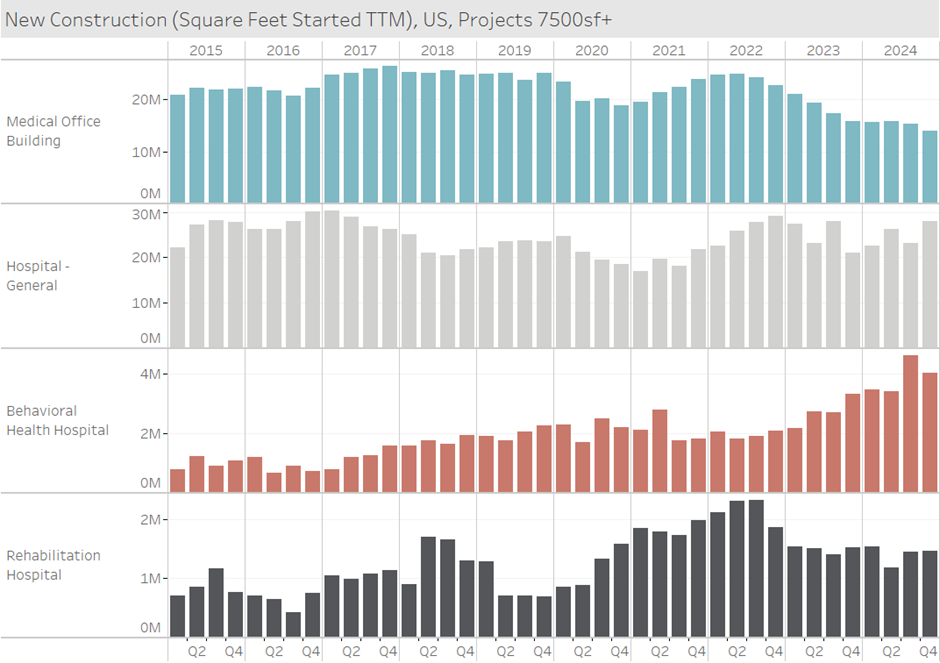

The amount of new MOB construction has fallen since the peak in 2022, and the back end of 2024 was no exception. With right around 14 million sf breaking ground in 2024, the blue bar chart clearly shows 2024 had less than typical construction starts compared to the past decade. While new projects getting started have declined, the square footage that is completing and opening for business is fairly normal, due to the influx of new projects in 2022. However, once the lack of new projects pulls the pipeline to a lower level, we could see inventory growth slow down temporarily. This could allow occupancy to maintain the upward march we have witnessed over the past few years.

The story has been different on the inpatient side. General hospitals have maintained an average level of new construction. Interestingly, the past few years have had a lower number of projects, but the average project size has been higher. Behavioral health construction was the strongest it’s been, with over 4 million sf breaking ground in 2024. Rehab Hospitals show a similar amount of construction as 2023, which is historically high, but lower compared to 2021 and 2022. Despite high construction costs, there is still a lot going on in the development world, so stay tuned as we continue to monitor the direction of the market.