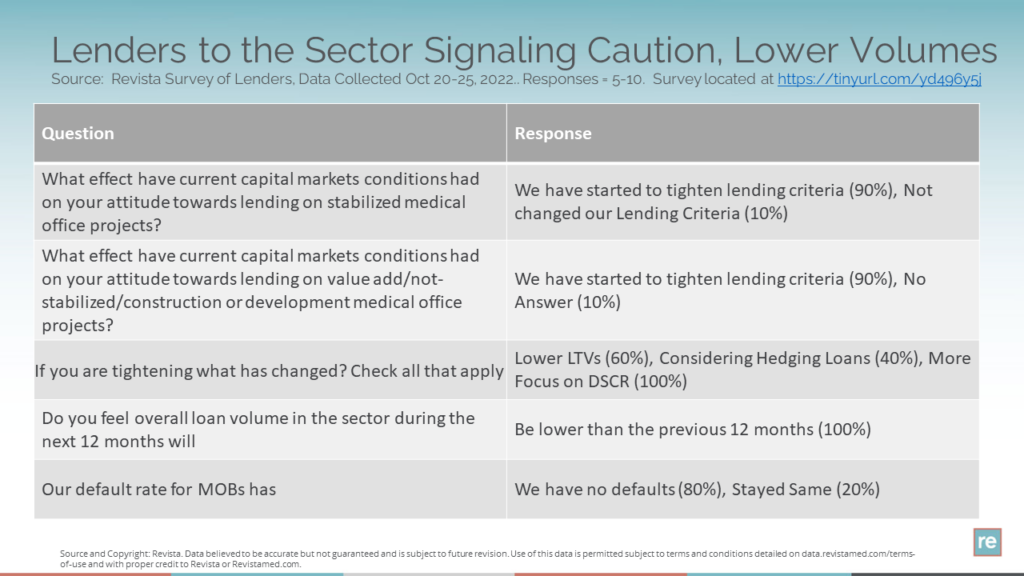

The inverted yield curve usually signals an upcoming recession. Rates have been rising dramatically for several months. Given the uncertainty, Revista decided to conduct a quick survey of major lenders to the HCRE sector. Revista posed this survey from 10/20/22 to 10/25/22. 5-10 major lenders to the sector responded to the survey. An image of the questions and response summaries is provided below but here are some brief highlights.

- Lenders have generally begun to tighten underwriting criteria towards stabilized and value add medical office (MOB) projects.

- The tightening techniques include lower LTVs, Hedging Loans and a greater focus on DSCR.

- All lenders indicated loan volumes will likely be lower over the next 12 months.

- The lenders either have no defaults or their default rate is unchanged, indicating stress is not pervasive.