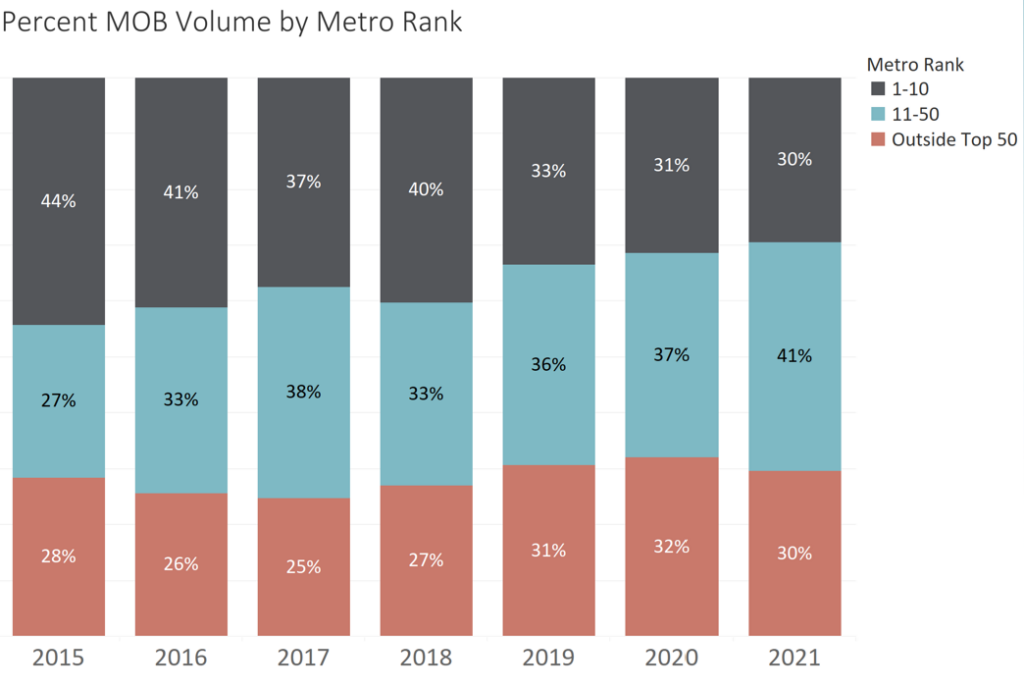

With competition remaining at all-time highs for quality medical office assets, investors are increasingly looking toward smaller, growth markets for opportunities. In 2015, 44% of medical office transaction volume was found in the largest ten metros in the country – this is NYC & Los Angeles down through Boston in terms of population. In 2021 that figure has fallen to 30%. Both secondary and tertiary markets have seen a marked increase in activity. Secondary markets range in size from Phoenix down to Buffalo, NY (ranked 11-50 by population for the purposes of this discussion). These markets represented 27% of buying activity in 2015 and have climbed to 41% in 2021. In 2021 some of these markets had significant gains in volume – markets like Richmond, Charlotte & Columbus saw over 100% increases in activity from 2020 to 2021. To find out more about this trend and others – come join us in San Diego next week for the 2022 MREIF!