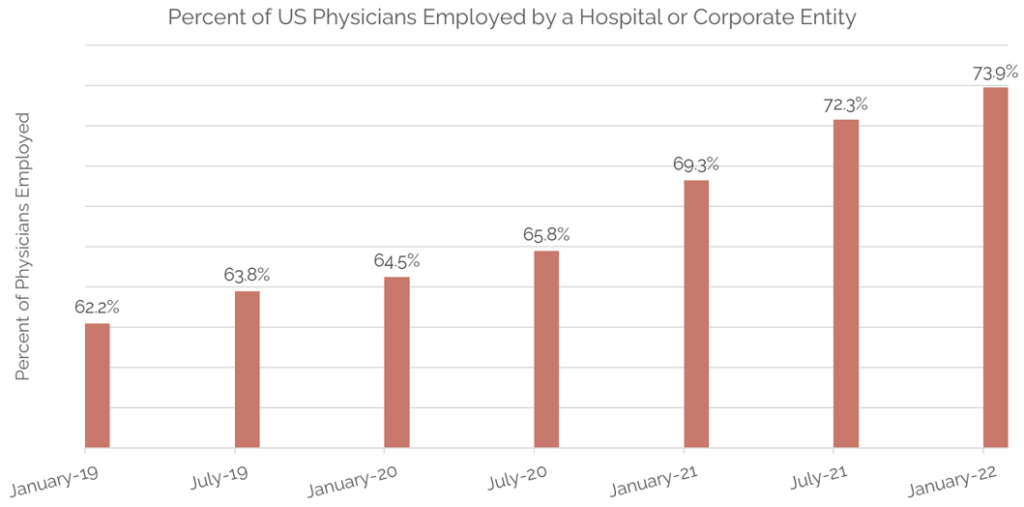

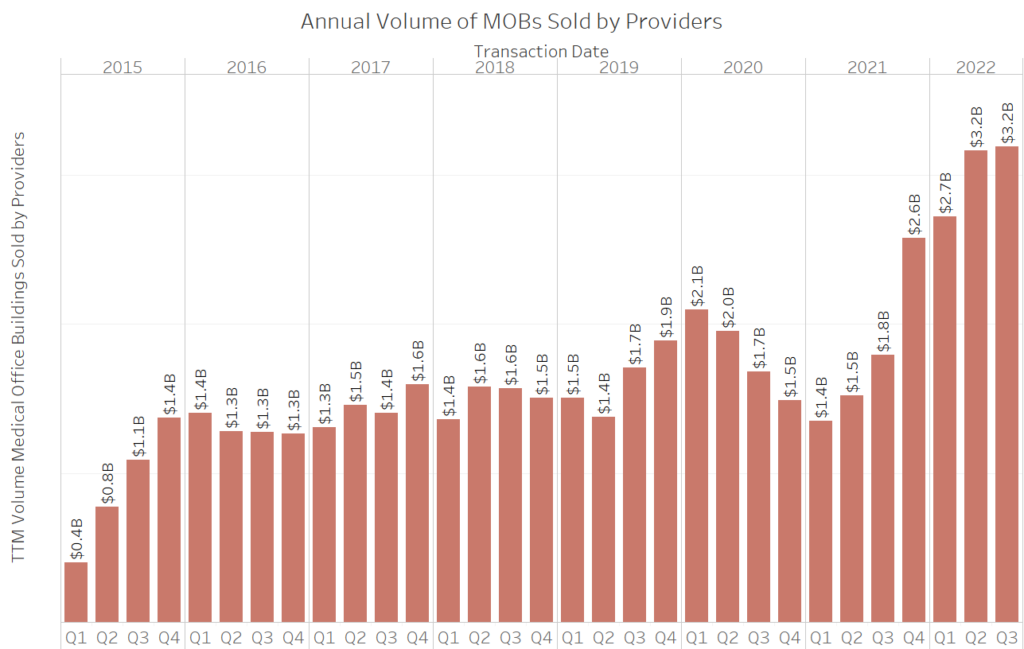

Consolidation of physician practices and providers has picked up significantly since the onset of the pandemic. According to a report released by Avalere, now almost 3 out of 4 physicians are employed rather than in independent practice. From January of 2019 to July of 2020, the percent of employed physicians increased 360 bps. From July 2020 to January 2022, that accelerated to 810 bps. Cost per patient continues to rise with reimbursements essentially flat. Thus far, physicians have been driving volume to bridge the gap. But is this pressure really behind the decision to sell? In addition to the increase in physician groups selling their practices, we have also seen an increase in the number of providers selling their real estate. In 3Q the annual volume of MOBs sold by a provider was $3.2B – more than double the typical annual run rate prior to the pandemic. Are these trends related? What is really driving this shift?

Collin Hart, Managing Director of ERE Healthcare, spoke on our Subscriber Webcast for 3Q and pointed out that although these trends of selling could be perceived to be a result of financial distress, that’s not always the case; selling of a practice or the real estate is often tied to succession planning. In their work with a variety of independent and specialty practices, his team has found that younger physicians are not always as interested in owning the practice or real estate which often catalyzes a transition to third party ownership. This dynamic reflects a fundamental change in how doctors view their businesses and career. It also highlights the opportunity this may represent to investors. Over 110 million square feet of medical office space in the US is still owned by independent physician groups. Stay tuned to Revista to follow this trend and more!