Revista recently held its 1Q23 Subscriber Webcast. Hilda Martin and Mike Hargrave of Revista were joined by Gino Lollio, an Executive Director with Cushman & Wakefield Healthcare Capital Markets. Over 230 subscriber lines registered for the webcast indicating a high level of interest in emerging trends we covered.

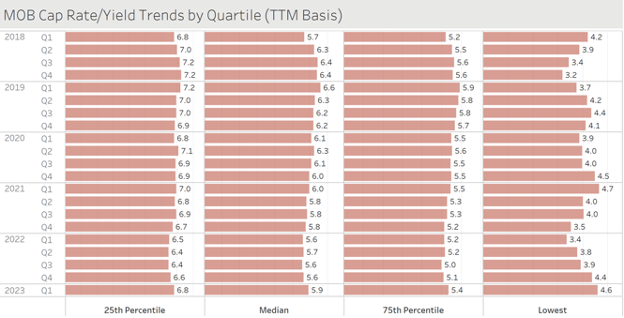

One of the key themes covered was “what were current cap rates within the sector”? To address this question, we pulled up Revista’s somewhat famous MOB Cap Rate/Yield Trends by Quartile chart (figure 1). The chart displays MOB cap rate trends for the US for the 25th percentile (higher cap rates), the median, 75th percentile and the lowest cap rate. When looking at these cap rates each percentile is trending upwards. The 25th percentile is up 20 bps from 4Q22 and 40 bps from its low of 6.4 in 3Q22. The median and 75th percentile are both up 30 bps sequentially. The 75th percentile had been holding on as it generally represents many of the “institutional” MOB trades occurring within the sector. Commenting on the trends, Mr. Lollio said while these cap rates might be moving up, they are not moving up as much as you might see in other CRE sectors (paraphrasing). It will be interesting to see the direction of cap rates in 2023 and Revista will make sure to track it!

Figure 1 (source: Revistamed)