When developing an investment strategy, many investors will focus on geographic areas that have a high level of population growth. But does population growth translate into more demand for space? (Spoiler alert – the answer is yes!)

The Census Bureau released metro level data showing cumulative population growth from April 1, 2020 through July 1, 2023 in an effort to show population changes since the Pandemic shutdowns. We used this data to segment the top 125 metro areas into 3 groups: metros that lost population, stayed relatively flat, or gained 2% or more during that period. For reference, the U.S. as a whole grew 1% during that time. The metros that lost the most population tended to be bigger metros like Los Angeles, Chicago, New York and San Francisco, and the metros that gained the most population tended to be smaller to midsize metros in the sunbelt like Lakeland, Port St. Lucie, Cape Coral and Myrtle Beach.

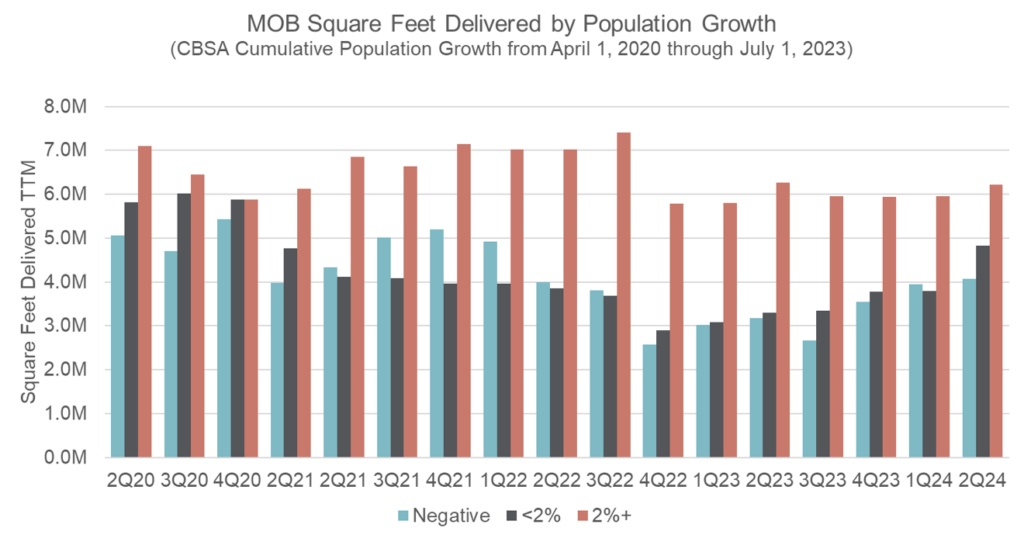

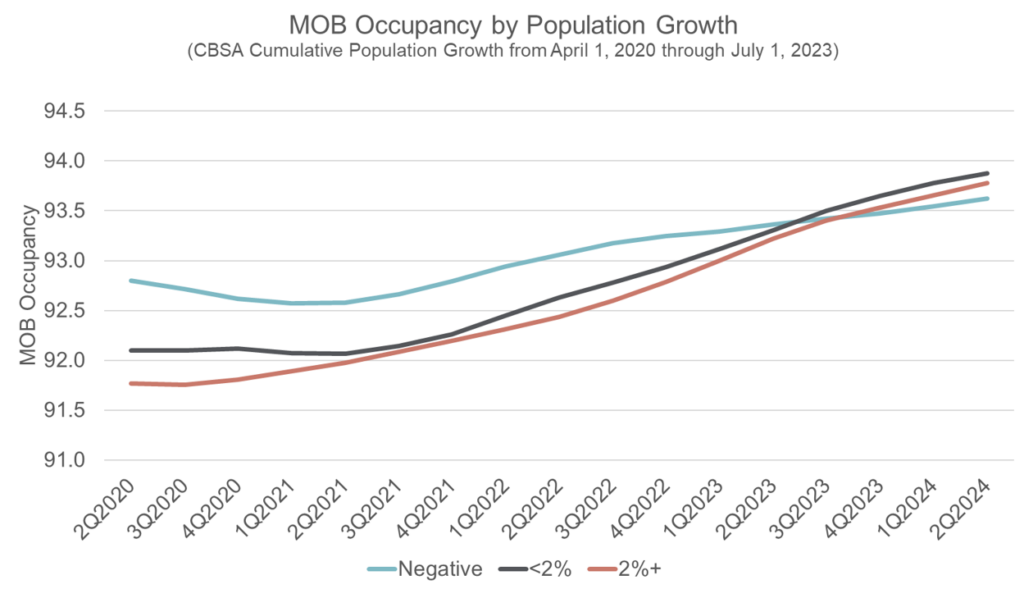

Volume of construction deliveries in metros that grew 2% or more was significantly higher than those metros that lost population or stayed the same. In the last three years, 19.5 million SF was delivered in the growth markets vs. 11.2 million SF in the negative growth markets. This is even more pronounced as the growth markets have overall lower population. In terms of absorption of this inventory, growth markets have absorbed this plus more. In 2020, there was a spread of 110 bps between occupancy in the 2%+ markets and the negative markets. Over the past few years that gap has completely closed with growth markets surpassing in occupancy gains. Want to know where your market stands? Check out our Metro Rankings!