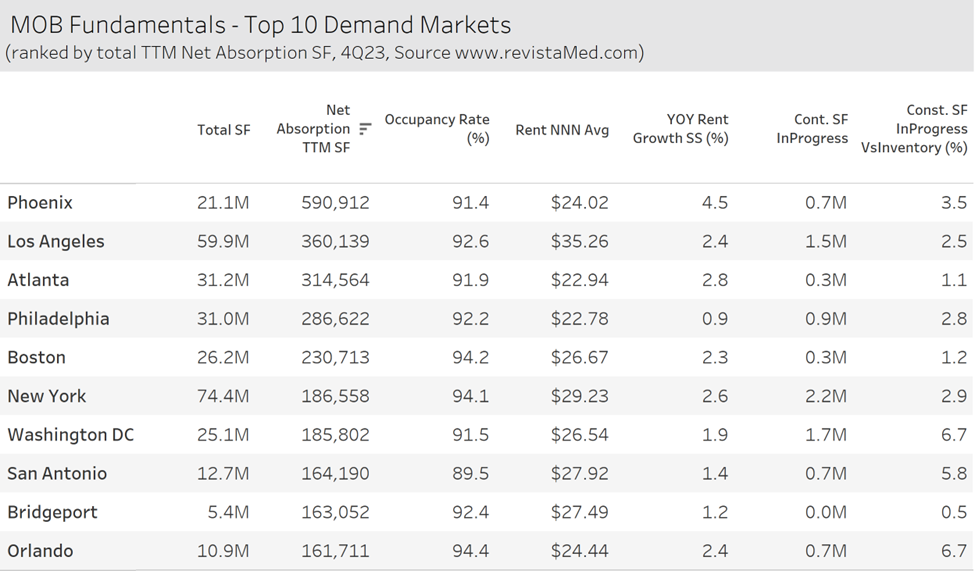

RevistaMed recently held its 4th Quarter Subscriber Webcast. During the presentation we discussed the top 10 demand markets (out of the largest 125). We ranked the markets top to bottom based on trailing twelve month (TTM) net absorption (defined as TTM absorption minus TTM completions). Topping the list was Phoenix as of 4Q23. It had TTM net absorption of 590,912 square feet. The Phoenix MOB market has seen tremendous growth since the middle of 2021. Its occupancy rate has risen from 85.4% to 90.1% since 2Q21. Los Angeles has also seen growth during this time. Its occupancy rate for MOBs has risen from 91.1% in 4Q21 to 92.3% as of 4Q23. All of the markets below had absorption in excess of completions over the past year. Boston, New York and Orlando were the tightest of the 10 markets with each showing occupancy in excess of 94%.

For more information on this please visit data.revistamed.com and consult our market data section for subscribers. We maintain quarterly rankings on all 125 metros on various metrics and you can also download trends for each market through the market data section.