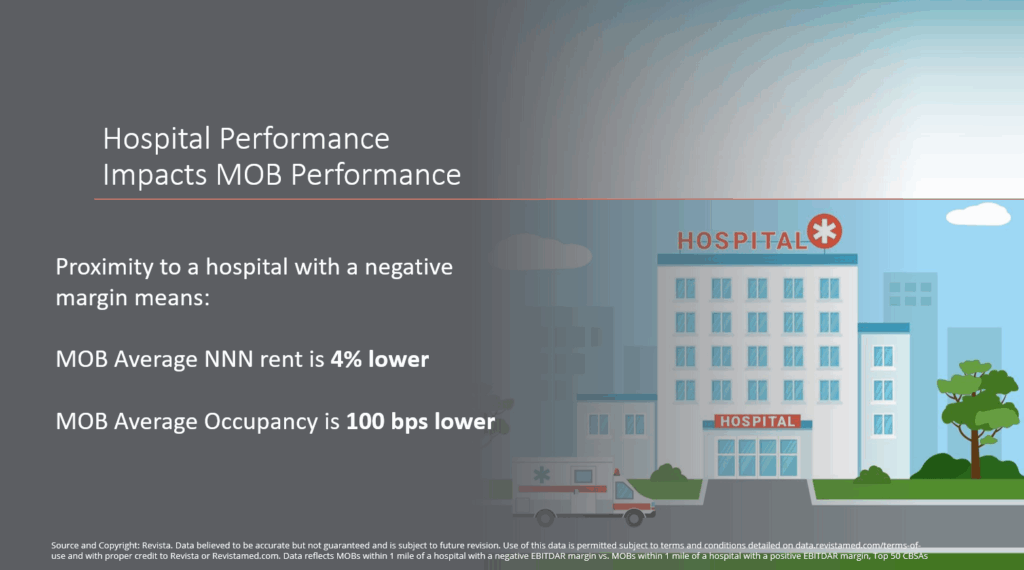

With the passing of the One Big Beautiful Bill, many hospitals across the country will be facing additional financial pressures in coming years. Millions of people are estimated to lose coverage under Medicaid and the ACA as rules to qualify will become more strict. Hospitals will bear the brunt of this as more care in ERs will go unpaid, and care avoidance will cause patients in the hospital to be sicker. This will not only pressure hospital budgets and their growth plans, but it can also impact the performance of outpatient buildings in close proximity. In analyzing data for MOBs within 1 mile of a hospital or on campus, we can segment those hospitals by whether they have a positive or negative EBITDAR margin. MOBs within one mile of a hospital with a negative margin have an average NNN asking rent that is 4% lower and average occupancy that is 100 bps lower. Overall, fundamentals in healthcare real estate are very strong. With robust demand and limited new inventory, MOB occupancy remains at peak levels. Impacts related to these cuts will likely be localized, particularly in areas with high Medicaid populations.