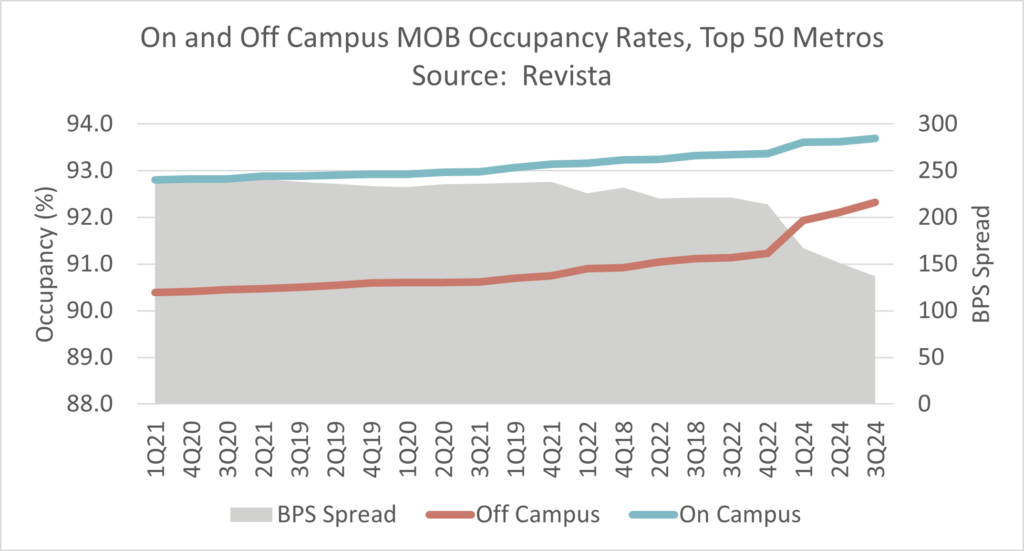

Did you know that Revista tracks both On and Off Campus medical office buildings (MOBs)? And starting in 2025 we will also track adjacent to campus MOBs. On and Off Campus MOBs have different operating characteristics particularly regarding ground leases and potential tenant or use restrictions. They have different investment profiles too and on campus MOBs have higher valuations than off campus MOBs. One reason why is the difference between their respective occupancy rates. Historically, on campus MOBs have run higher occupancy rates compared to off campus MOBs. The graph below shows an occupancy rate trend in the top 50 metros for both on and off campus MOBs. Traditionally, off campus MOBs have run occupancy rates some 200+ basis points lower than on campus MOBs. But there are signs that this is beginning to change in recent quarters. The spread between the 2 occupancy rate trends is now 137 basis points (3Q24) and has been declining at a faster rate for the past year+. Why is this happening? One reason could be that on campus MOBs are near their natural occupancy high (currently at 93.7%) and that off campus MOBs have a bit more room to run up (current occupancy is 92.3%). Will this continue? Tune into Revista or download the trends yourself from either the metro reports pages or the rankings pages which are available to subscribers. Schedule a discovery call today by contacting Hilda Martin (hilda@revistacompanies.com)