Medical real estate seems to be in a tide shift when it comes to sales activity. With a second 25-bps cut in the federal funds rate and the announcement of the Remedy/Welltower transaction, we already know 4Q volumes are going to exceed the quarterly levels we witnessed during the first ¾ of the year. Despite the excitement for what is ahead, here we are reflecting on what has gone on across more than just MOBs during the last year.

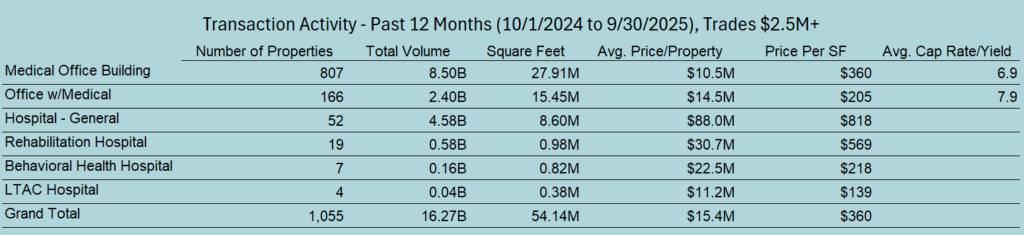

From the main property types that we track, we have seen 1,055 properties trade for a total of 54 million square feet and $16.3 billion. MOBs made up over half of that dollar volume, with General Hospitals and Office w/Medical taking up the bulk of what remained. Only a handful of specialty hospitals traded, with rehab seeing the most activity out of that subgroup. MOB cap rates averaged 6.9, showing a premium of 100 basis points compared to the mixed Office w/Medical property type.

Will these numbers change drastically one year from now? For reference, the average combined annual volume for these property types from 2016-2024 was $24 billion for 75 million square feet. So, 2025 activity ran around 2/3 of the average. Only time will tell, but make sure to keep your eyes peeled, because the coming year is set for more movement than we have seen lately.