The idea of a K-Shaped economy is a much talked about topic these days. The concept is that higher earners are doing quite well while those in lower to middle income brackets are struggling with stagnant wages and higher costs. The K-Shape can also play out with rent data where higher rents keep climbing while middle to lower tier rents are flat to even falling. But is a K-Shape emerging with regard to MOB rent trends?

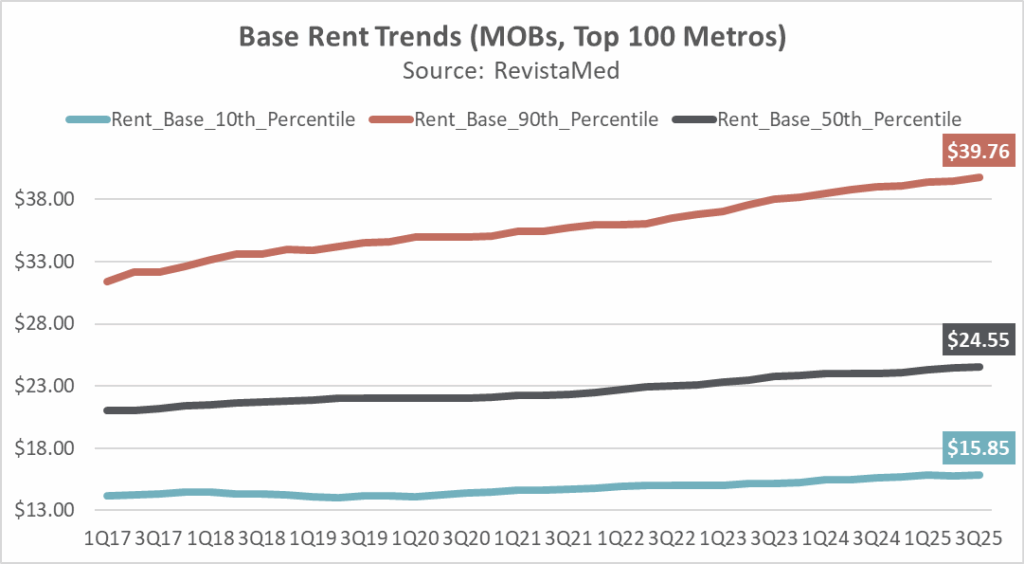

The chart below shows base rent trends for MOBs located within the nation’s 100 largest metro areas. The rents are per square foot (on an annual basis) and are equivalent to reported face rents that are not adjusted up or down. So, it does appear that a similar rent trend is emerging in health care real estate. The 90th percentile base rent was $39.76 per SF in 3Q25 while the 50th percentile base rent was $24.55, and the 10th percentile base rent was $15.85. Since 1Q18, the 90th percentile base rent has been growing by an average of 2.7% each year while the 50th percentile has been growing by an average of 1.8% and the 10th percentile has been growing by an average of 1.3%.

So the base rent trends do resemble some of the characteristics of a K-Shaped economy. In the last year, however, the 50th percentile base rent has been the best performer at 2.3% vs 1.9% for the 90th percentile and 1.6% for the 10th percentile. Subscribers can examine these trends for each of the top 125 metros through RevistaMed’s metro trends.