Columbus, Ohio is the 21st largest market RevistaMed tracks in terms of outpatient or medical office square feet. Columbus has been in growth mode for the past few years from a healthcare real estate perspective. OSU Wexler has embarked on a $3B plus plan to build a new 1.9 million square foot inpatient tower as well as an ambitious outpatient care center in Powell, OH. Ohio Health has also been growing and recently delivered a 200,000+ SF addition to its Pickerington Hospital. Ohio health has also been active in delivering several new freestanding ERs in various communities in central Ohio. Hammes Company as well as the Daimler group have been the most active developers in the market. In all, the outpatient market in Columbus has grown by over 1.3 million square feet from 2021 to 2023.

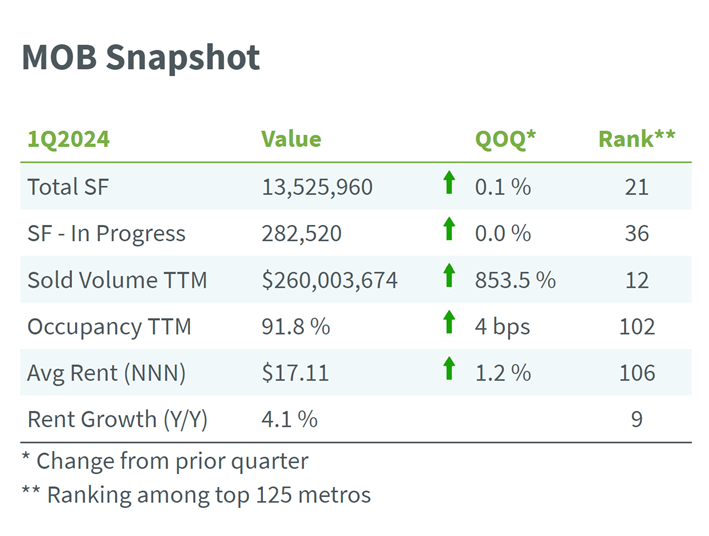

Despite the growth, however, the Columbus outpatient market has held up well from an occupancy perspective. The 1st quarter, 2024 outpatient occupancy rate was 91.8%, according to Revista Med. While the occupancy rate is down slightly from its high of 92.2% one year ago, it is maintaining its level in the face of an increase in the underlying supply of over 10% during the past few years.

Columbus also boasts an active transaction market for outpatient real estate. The market has seen over $200 million of medical office properties trade during the past 12 months. And Columbus ranks 9th among the top 125 metros for rent growth. SS rent growth has been climbing recently in the market and now sits at 4.1% as of 1Q24.