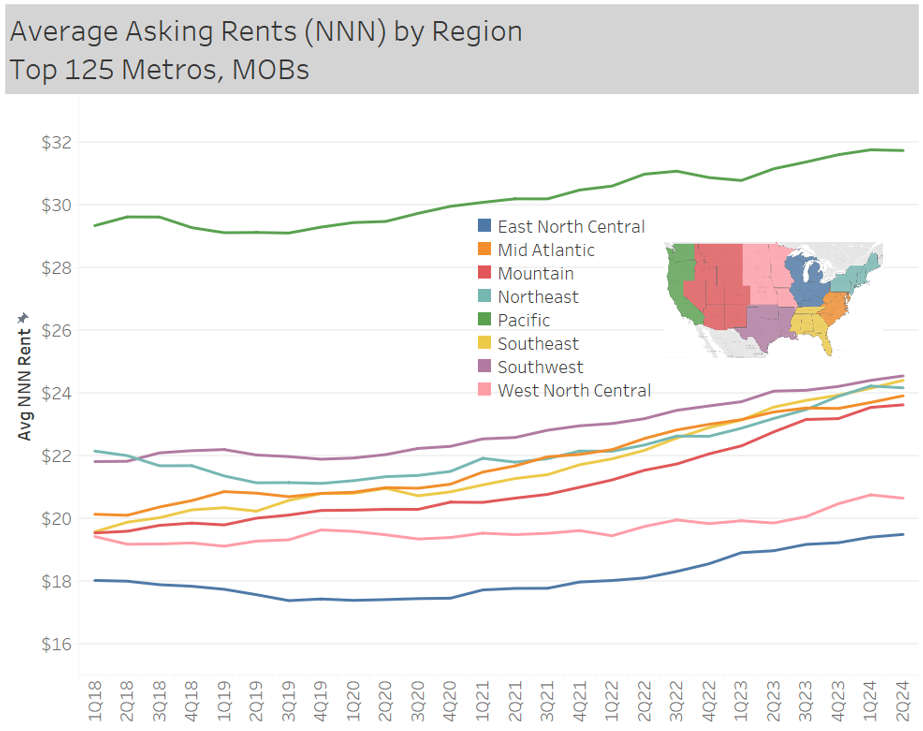

Which regions have the highest rents? According to the following graph, which covers the largest metro areas across the U.S., the Pacific region is the outlier. In 2Q24, the Pacific had asking rents 29% higher than the Southwest (2nd highest). East North Central and West North Central have the lowest rents, with 2Q24 averages of $19.48 and $20.64 respectively. The other five regions have converged over the past several years, now all sitting in the range of $23.62 – $24.54.

Despite having the highest rent level, the Pacific region had the lowest growth over the past year. The average rent is 1.9% higher than in the second quarter of last year. The Northeast was the highest in this regard, with 4.2% growth year-over-year. Strong growth has been observed across the country in recent years, but now that general inflation is softening, our data has started to show a softening in rent growth as well. If we shift our focus to same-store rent growth instead of average NNN, the overall average was 2.2% in 2Q24, vs. 2.9% in 2Q23.