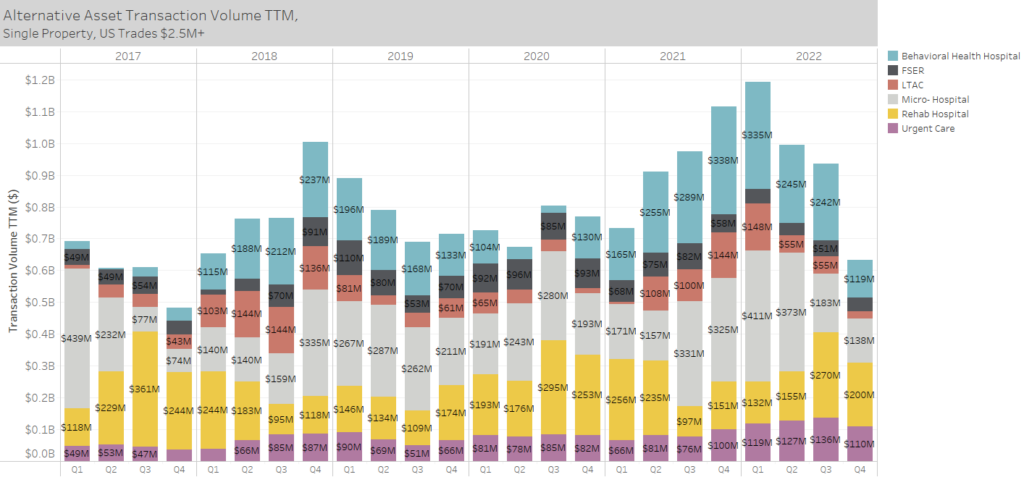

What level of sales activity are we seeing around alternative types of medical real estate? The chart below shows the annual transaction volume for some different property types. Large portfolios tend to skew the data, so right now we are just looking at single property trades. We can see that the end of 2021 contained elevated sales activity. If we were to look at individual quarters, 4Q21 had the highest quarterly volume at around $420 million for these assets. During this peak we can see especially strong activity around behavioral health hospitals and micro-hospitals. Towards the back-end of 2022 activity has been tapering off, but not to levels that are out of the ordinary. The expectation is that transaction volume will continue to be slow into 2023, but we will have to wait and see. Make sure to stay tuned as we continue to monitor how the market is reacting to the shifting economic environment.

Source and Copyright: Revista. Data believed to be accurate but not guaranteed and is subject to future revision. Use of this data is permitted subject to terms and conditions detailed on data.revistamed.com/terms-of-use and with proper credit to Revista or Revistamed.com.