This morning the BEA released its first official estimate of real GDP growth for 2Q22. It came in at -0.9. The revised official rate from last quarter was -1.6, and depending on the definition used, some would now say that we are in a recession. Regardless of whether we are technically in a recession, investors need to stay alert within this economic environment. If the Covid recession does in fact have a sequel, what can we expect out of the MOB sector? Every economic cycle is unique and the environment of the initial Covid recession was characterized by lockdowns and high unemployment, which is different from current conditions. However, it is still useful to look at how MOB fundamentals have held up over the past few years.

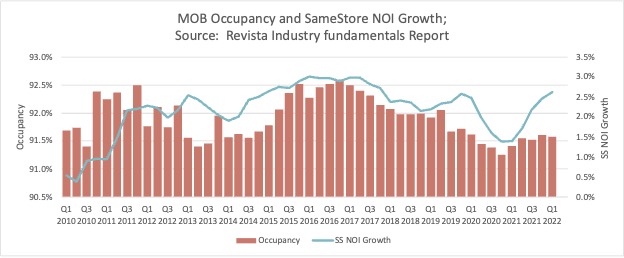

If we look at the quarterly occupancy (first graph) during 2020, we can see it dipped about 40 basis points in comparison to the end of 2019. This goes side-by-side with a decrease in the growth of net operating income (NOI) of about 1%. Since 2010, the aggregated industry ranges have been:

- Occupancy: (91.3% – 92.6%)

- NOI Growth: (0.4% – 3.0%)

The stable long-term trends can provide comfort to investors, as the sector has proved resilient over long cycles and through economic downturns. Recently, both metrics have been trending back up, and hopefully these give a clearer picture of what are the possibilities going forward.

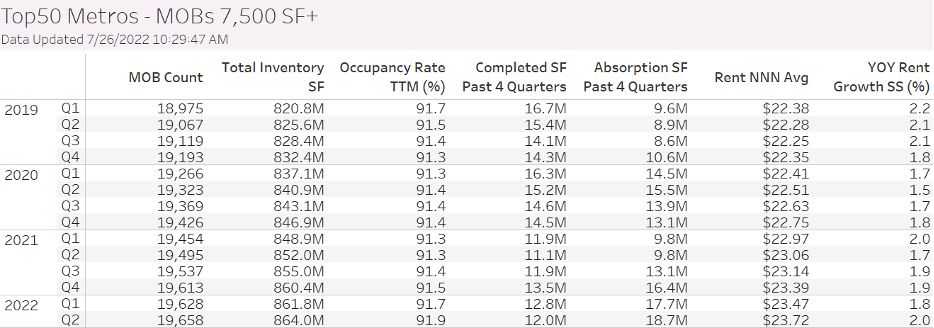

If it we look at some other fundamentals in the shorter term, we can see that rent growth did have a low that corresponded to the peak of the recession, but it has slowly gravitated back towards 2019 levels. We saw completed projects slow down due to uncertainty, delays, and rising costs. Absorption has been rather volatile, but it is now stronger than ever. No one can predict exactly how the economic situation will unfold, but the MOB sector has not given us a reason to be worried. We will continue to keep an eye out, and if you want the most in-depth view of our numbers, be sure to check out our 2Q22 subscriber webcast from last week.