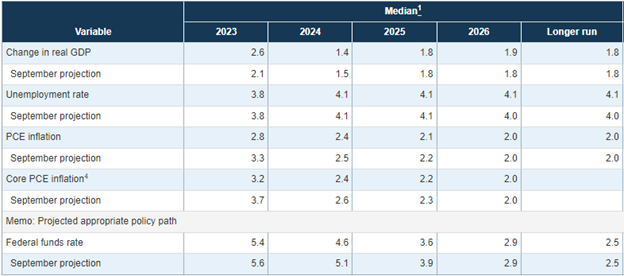

For all of 2023 investors have been waiting for more clarity on the monetary policy path. The FOMC meeting last week provided what many have been waiting for. The median projection for the federal funds rate is now 4.6 for the end of 2024. This leaves room for three 25 basis point cuts throughout the year. While not shown in the graph below, the full range of forecasts for 2024 is 3.9 – 5.4. This indicates that all the meeting participants are predicting no rate hikes in 2024, which is a first for this year. Of course, there is always a possibility that an unexpected event pushes us off track, but the data so far has shown promising progress on inflation. PCE inflation is expected to read at 2.8% for the month of December, which would be down approximately 60% from the peak in June 2022 (7.1%). Does this mean that medical office sales will start to pick up in 2024? Possibly, so stay tuned as we continue to monitor how the Fed’s pivot is reflected in activity within the healthcare real estate market.